Dublin, Sept. 04, 2023 (GLOBE NEWSWIRE) -- The "China Elevator & Escalator Market By Type (Elevator, Escalator, and Moving Walkways), By Elevator Technology, By Elevator Door Type, By Service, By End User, By Region, Competition, Forecast, & Opportunities, 2028" report has been added to ResearchAndMarkets.com's offering. The China elevator & escalator market has demonstrated remarkable growth, reaching a valuation of USD 32,602.69 million in 2022, and is projected to maintain a steady upward trajectory with a CAGR of 6.78%

This surge is attributed to the escalating investments in both commercial and residential infrastructure projects, spanning across well-established urban landscapes and burgeoning developments. These pivotal investments are reshaping the vertical transportation landscape, driving the demand for elevators and escalators in various settings such as residential complexes, commercial hubs, shopping malls, and healthcare institutions. China Spiral Conveyor

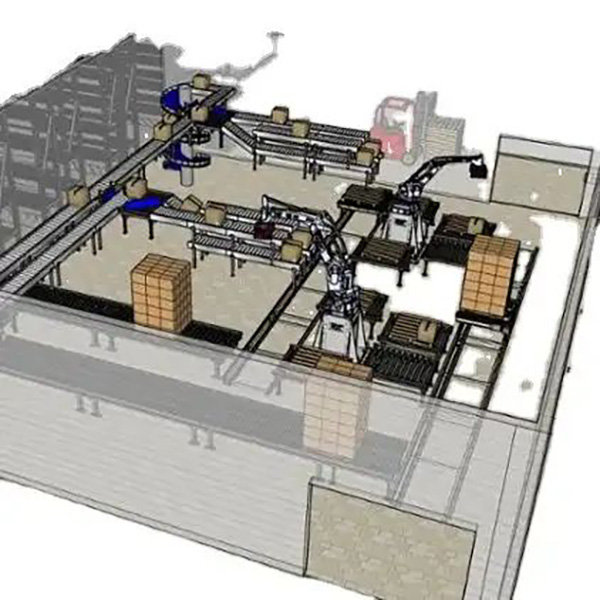

Furthermore, the application of elevators extends to industrial facilities, where they play a crucial role in moving supplies, equipment, and finished products across different levels. Likewise, escalators, characterized by their continuous moving steps, facilitate efficient movement of people between floors in modern buildings, enhancing accessibility and convenience. Utilization of UltraRope Technology for High-Rise Buildings The lift can travel up to a height of around 1,000 meters due to the ultra-lightweight lift lifting technology known as UltraRope. The demand for UltraRope technology is rising along with the number of high-rise offices and residential structures.

For instance, KONE UltraRope from KONE does away with the drawbacks of traditional steel ropes, such as excessive energy consumption, rope stretch, big moving masses, and downtime brought on by building wobble. Since it is made of a carbon fiber core and a special high-friction coating, the KONE UltraRope is exceptionally light. This results in an 11 percent reduction in lift energy usage. Technological Developments by Major Industry Players Market leaders, such as OTIS, Toshiba, Schindler, and KONE, are investing in IoT and Intelligent Services to track and improve the service of lifts by predicting how frequently the machinery needs to move up or down and the amount of weight that lifts can carry with the destination-based operation.

For instance, hospitals and other medical institutions in nations that are particularly affected by Covid-19 were offered digital solution packages based on Thyssenkrupp Elevator's cloud-driven predictive maintenance platform MAX free of charge. Increasing Number of Smart Cities The construction of smart cities includes building information modeling (BIM) and intelligent vertical mobility. Digital technologies are used in smart city solutions to address social, environmental, and economic objectives. Shanghai has underlying factors that allow it to develop into a leading smart city globally.

Through important domestic programs, including the Smart Cities Plan, City Deals, the Smart Cities and Suburbs Programme, and the National Cities Performance Framework, the government is significantly advancing the development of smart cities. One of the recent start-ups in China that creates smart city management software and apps is Freedo. A smart city, also known as a digital, intelligent, or wired city, is a metropolitan area where technology and sensors are used to gather data, which is then used in real-time to manage the city's utilities and resources.

For Instance, this is done by enhancing the quality of the city's infrastructure and services and lowering waste, energy use, and pollution. For machines, cars, systems, and devices to connect with each other, smart cities are built on critical technologies, such as 5G and the IoT. They also rely on an ecosystem of software and data platforms to store and process data in real-time.

Almost all Chinese provinces and regions have included the idea of smart city development in their development goals for the 14th Five-Year Plan (2021 to 2025). Providing smart governance and services is one of them. More than a billion people utilize China's national e-government service platform, which offers more than 10,000 standardized services. Rapid urbanization, economic development, and the uptake of new technologies are predicted to push China cities to install cutting-edge vertical transportation systems, which is anticipated to further boost the country's escalator and lift the market throughout the forecast period. Increasing Commercial & Residential Infrastructure China spent approximately USD 1 trillion on infrastructure projects in 2022. North China is also emphasizing the development of renewable energy in desert regions. Wind and solar energy projects will start development in 2022 and should be finished by 2030. However, the People's Republic of China's Ministry of Commerce reports that, in August 2022, China received close to USD 14.5 billion in monthly FDI inflows. Additionally, FDIs increased by 20% in 2021 compared to the year before, reaching a total of more than USD 170 billion. Infrastructure development is planned to be vertical to manage the expanding population, with the construction of high-rise structures and skyscrapers, shopping centers, retail stores, and residential flats. Additionally, the need for building renovation is being driven by changes in lifestyle, which is favorably impacting this market. As a result of all these advancements, the China elevator & escalator market is projected to grow during the forecast period. Market Growth Hindered by High Installation and Maintenance Cost Since more buildings are being built, the China elevator & escalator market has been expanding quickly. However, escalators and lifts require a significant financial expenditure for installation and upkeep. The complexity of the machinery and the specialized end users have simultaneously raised the price.

Additionally, increasing energy usage raises operating costs. Due to the capital-intensive nature of the sector, prospective investors would have to make significant upfront payments for the construction and setup of lifts and escalators. As a result of the demand for these additional technologically sophisticated systems, the cost of installation and maintenance also increases for high-speed escalators' safety features and associated equipment, control systems, and power efficiency; due to these factors, the market is likely to be hindered during the forecast period.

Competitive Landscape Company Profiles: Detailed analysis of the major companies present in the China elevator & escalator market.

Schindler China Elevator Co. Ltd.

Otis Elevator China Co Ltd

Shanghai Mitsubishi Elevator Co., Ltd.

Toshiba Elevator China Co Ltd.

Hitachi Elevator (China) Co., Ltd.

Disheng Elevator (China) Co., Ltd

Annual Maintenance Contract (AMC) Expectation

Annual Maintenance Contract (AMC) Challenges

China Elevator & Escalator Market, By Type:

China Elevator & Escalator Market, By Elevator Technology:

China Elevator & Escalator Market, By Elevator Door Type:

China Elevator & Escalator Market, By Service:

China Elevator & Escalator Market, By End User:

China Elevator & Escalator Market, By Region:

For more information about this report visit https://www.researchandmarkets.com/r/99iazh

Continuous Lifter About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.